Round-tripping means a combination of transactions involving transfer of money across jurisdictions, eventually resulting in a return to the jurisdiction of origin. Simply, for example, an Indian entity sets up a subsidiary outside in the USA and that company uses these proceeds to invest back in India.

RBI considers such transactions from suspicion of being not bona fide and are perceived to be designed for the purpose of tax evasion/ tax avoidance. Accordingly, the RBI, historically, has had a strict approach towards transactions that could be structured with Indian funds remitted abroad and then used to create assets or resources in India.

RBI Rules or Regulations do not specifically mention the terminology of Round Tripping but issued an FAQ in 2019 addressing the issue. RBI vide the FAQ No. 64 of the Frequently Asked Questions on Overseas Direct Investments permitted an Indian Party to set up Indian subsidiary(ies) through its foreign Wholly Owned Subsidiary or Joint Venture only with the prior approval from RBI before entering such transactions.

See : Inbound & Outbound Investment Strategies in India

Due to the above FAQ, Fund-raising options from offshore investors were restricted as it required prior RBI approval. Similarly, Indian entities considering outbound investments faced a requirement of prior RBI approval if the target had any investment in India. Although the objectives of the restriction on round tripping was laudable, such restriction also had an unintended effect on the legitimate transactions.

Before notifying Foreign Exchange Management (Overseas Investment) Rules, 2022 and Directions, 2022, RBI introduced draft Foreign Exchange Management (Non-debt Instruments – Overseas Investment) Rules, 2021 dated 9 August 2021 which stated that “The Financial Commitment by a person resident in India in a foreign entity that has invested or invests into India, at the time of making such Financial Commitment or at any time thereafter, either directly or indirectly, which is designed for the purpose of tax evasion/ tax avoidance by such person is not permitted and any contravention under this rule shall be considered to be a contravention of serious/sensitive nature.”

But, on 22 August, 2022, RBI issued Foreign Exchange Management (Overseas Investment) Rules, 2022 & Foreign Exchange Management (Overseas Investment) Directions 2022 which notified the regulations for the round tripping without mentioning about the tax evasion/avoidance.

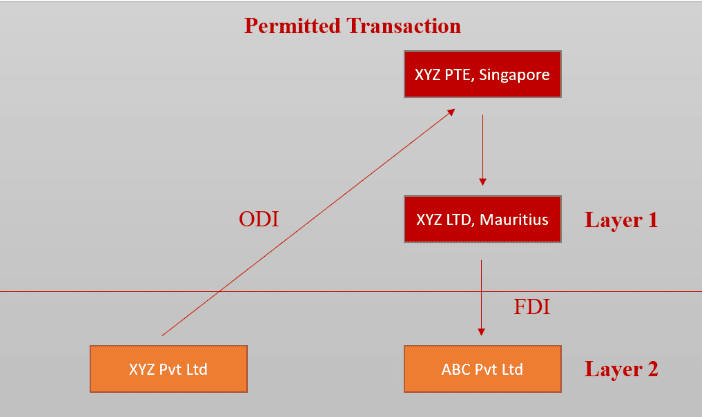

Rule 19(3) of the OI Rules prescribed that: “The financial commitment by a person resident in India in a foreign entity that has invested or invests into India at the time of making such financial commitment or at any time thereafter, either directly or indirectly, resulting in a structure with more than two layers of subsidiaries is not permitted.

The provision intends to allow a person resident in India to make an investment in a foreign entity that has invested or invests back into India (without any prior approval from the RBI) up to 2 layers of subsidiaries.

Subsidiary of a foreign entity means an entity in which the foreign entity has control.

Control has been defined under OI Rules as the right to appoint majority of the directors or to control the management or policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly, including by virtue of their shareholding or management rights or shareholders’ agreements or voting agreements that entitle them to 10% or more of voting rights or in any other manner in the entity.

The law does not specifically indicate about the calculation of 2 layers of subsidiary to be calculated from Indian entity stand point or in relation to the foreign entity.

But as the definition of Subsidiary provides that the subsidiary means an entity in which the foreign entity has control, therefore, the layers of subsidiary will be determined with reference to the foreign entity. Further, RBI’s Master Directions on Reporting which provides instructions for filling Form FC requires information of the step down subsidiary of foreign entity which clearly supports the view point of calculating layers of subsidiary from the foreign entity.

This was a long awaited change by the RBI to liberalize the regulations governing such structures allowing Indian businesses to expand their presence globally and make a downstream investment into India.