Non-Resident Individuals (NRIs) contribution to India’s financial, social and economic condition is significant. Inward remittances by NRI either through remittances or investments augment the foreign exchange reserves of India and strengthen the national savings. The sheer size of the remittance enables not only in remittances but also transfer of technology, global best practices & knowledge. The grand success of the “Indian Development Bonds” issued by SBI in 1991 and “Resurgent India Bonds” in 1998 showcased their immense contribution even in turbulent times.

With the objective of facilitating the NRI and to promote their role in our economy, Indian Government has liberalized the regulatory and taxation mechanism to pave way for more economic growth.

Determination of the residential status is the critical step to determine the applicability of the tax or regulatory provisions. Let us decode the criteria to determine the residential status which has been defined under the Income Tax Act, 1962 and Foreign Exchange Management Act, 1999:

Income Tax

As per Section 2(30) of the Income Tax Act, 1961, “non-resident” is defined as a person who is not a “resident”.

As per Section 6 of Income Tax Act, 1961, an individual is said to be resident in India in any previous year, if he-

- Is in India for 182 days or more during the relevant financial year or;

- Is in India for 60 days or more during the relevant financial year and his cumulative stay is 365 days or more in 4 financial years preceding the relevant financial year.

Any individual who does not satisfy both the conditions as mentioned above will be treated as “non-resident” in that previous year.

But, a citizen of India, who leaves India in any PY as a member of the crew of an Indian ship, or for the purposes of employment outside India, the period of 60 days in relevant financial year shall be substituted with 182 days in (b) above.

However, in respect of an Indian citizen and a person of Indian origin who visits India during the year, the period of 60 days as mentioned in (b) above shall be substituted with 182 days.

As per the amendment in Finance Act, 2020, an individual, being a citizen of India or person of Indian origin, having total income (other than income accrued or arising from foreign sources) exceeding ₹15 lakh, the period of staying in the country shall be 120 days or more rather than 60 days as prescribed in (b) above. [“Income from foreign sources” means income which accrues or arises outside India (except income derived from a business controlled in or a profession set up in India)] [and which is not deemed to accrue or arise in India]

Foreign Exchange Management Act

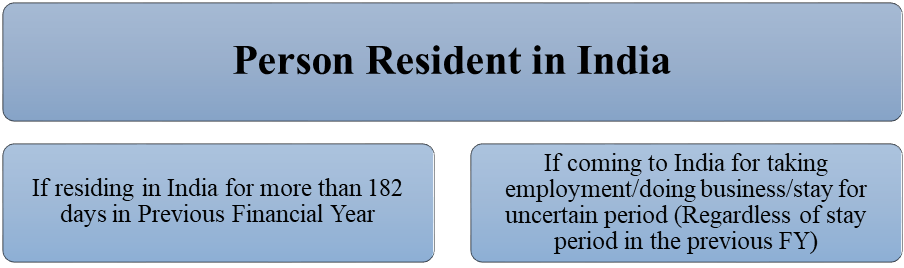

Now, Residential status as per Foreign Exchange Management Act, 1999-

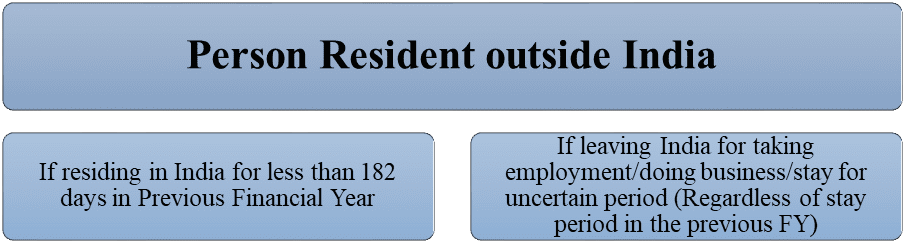

“Person resident outside India” is defined as a person who is not resident in India.

In accordance with Section 2(v), person resident in India means a person residing in India for more than 182 during the course of the preceding financial year but does not include:

(a) A person who has gone out of India or who stays outside India:

- for employment outside India; or

- for carrying on a business or vocation outside India; or

- for any other purpose, in such circumstances as would indicate his intention to stay outside India for an uncertain period.

(b) A person who has come to India or stays in India for any purpose other than:

- for employment in India, or

- for carrying a business or vocation in India, or

- for any other purpose, in such circumstances as would indicate his intention to stay in India for an uncertain period;

Clause (a) prescribes that a person shall be considered a “Person resident outside India” irrespective of his residence period in India in the previous financial year when he has gone out of India for employment/ carrying business/ or any purpose which indicates his intention to stay outside India for an uncertain period.

Clause (b) prescribes a person shall be considered a “Person resident in India” irrespective of his residence period in India in the previous financial year when he has come to India for employment/ carrying business/ or any purpose which indicates his intention to stay in India for an uncertain period.

Note There is a distinction between ‘stay’ and ‘reside’. ‘Stay’ means physical presence in India while ‘reside’ indicates permanency.

Note 2: If a person leaves India for any of the purposes mentioned in (a), he will be regarded as a non-resident from the date of leaving from India even if he has stayed in India for more than 182 days in the preceding financial year. Therefore there can be 2 residential statuses in a particular Financial Year under FEMA.

Key Differences:

| Description | Income Tax Act | FEMA Act |

| Basic Conditions for Resident Individual | (a) Is in India for 182 days or more during the relevant financial year or; (b) Is in India for 60 days or more during the relevant financial year and his cumulative stay is 365 days or more in 4 financial years preceding the relevant financial year. | a person residing in India for more than 182 during the course of the preceding financial year |

| Number of Residential Status in a FY | One residential status for the relevant year | There can be more than one residential status for the relevant year |

| Impact of Citizenship | Citizenship conditions are prescribed separate regulations | Citizenship is not important |

| Impact | The residential status impacts the Taxation | The residential status impacts the regulatory mechanism like remittance, payments etc. |

Questions: What will be the residential status if a person leaves India for Employment under FEMA?

Reply: The residential status of the person shall be Person resident outside India from the date he leaves India for employment even when he has stayed in India for more than 182 days in the preceding Financial Year.

Question: Is citizenship a relevant criterion to determine residential status under FEMA?

Reply: No, residential status under FEMA is determined on the basis of residence in India.

Question: A person from outside India visited India for tourism. What will be the residential status under FEMA?

Reply: As the person is visiting India as a tourist, therefore the residential status will be “Person resident outside India” irrespective of his stay period because he has come to India neither for employment/business/he has no intention to stay in India for an uncertain period.

Question: A person from outside India came to India for the purpose of employment during the current financial year. What will be the residential status under FEMA?

Reply: Section 2(v) of the FEMA provides an exception that irrespective of the period of stay in the previous financial year, the person shall be considered a “Person resident in India” when he comes to India for the purpose of employment.