In accordance with the Foreign Exchange Management Act, 1999, a resident outside India is not allowed to hold a savings account in India. When a person resident in India leaves for:

- Employment outside India; or

- For carrying on a business or vocation outside India; or

- For any other purpose, where his intention to stay outside India is for an uncertain period,

his residential status changes to Resident outside India and his existing account should be changed to Non-resident Ordinary (NRO) Account. In accordance with Foreign Exchange Management (Deposit) Regulations, 2016, there are 3 types of accounts that can be opened by a Person resident outside India.

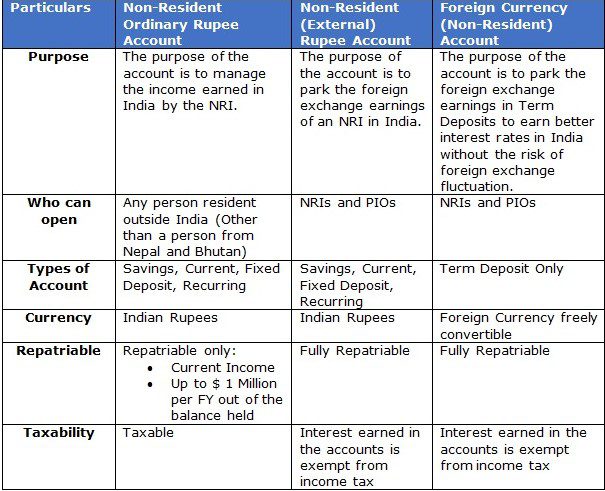

Non-Resident (Ordinary) Rupee Accounts

NRO Account is a Rupee Denominated Account that is widely used by NRIs to receive and manage receipts of income earned in India like rent, dividends, interest, pension etc.

The purpose of the account is to manage the income earned in India by the NRI.

Salient Features:

- The account is denominated in Indian Rupees

- The account can be savings, current, fixed deposit or recurring.

- The account is used by NRI to receive income like dividends, pension, interest, rent etc

- The account is also used by NRI to park the foreign earnings in Indian Rupees, sales proceeds of assets in India or legitimate dues in India.

- The amount held in the NRO account are remittable up to USD 1 million per financial year.

- All the current income earned i.e. interest, dividend are repatriable subject to payment of applicable taxes.

Non-Resident (External) Rupee Accounts

NRE Account is a rupee denominated account that can be opened by an NRI to deposit their foreign exchange earnings in INR with the facility of full repatriation option.

The purpose of the account is to park the foreign exchange earnings of an NRI in India.

Salient Features:

- The account is denominated in Indian Rupees

- The account can be savings, current, fixed deposit or recurring.

- The deposits in this account are only by way of remittance from outside India, sale proceeds of the investment if such investments were made from this account, etc.

- NRI can use the amount held in this account for investment in securities, shares, commercial papers etc.

- Any interest earned on the deposit held in the NRE account is exempt from Income Tax

Foreign Currency Non-Resident (Banks) Account

FCNR(B) Account is a foreign currency denominated account that can be opened by an NRI to invest in term deposits in India.

The purpose of the account is to park the foreign exchange earnings to earn better interest rates in India without the risk of foreign exchange fluctuation.

Salient Feature

- The account is denominated in Foreign Currency

- The account can only be in the form of term deposit of 1 to 5 years

- The principle amount with interest can be freely repatriable to outside India without any limit

- Interest earned in this account is not subject to Income Taxation in India

Difference between the 3 Bank Accounts

Question: Is Non-Resident Indian allowed to have a saving account in India?

Reply: In accordance with FEMA Act, an NRI is not allowed to have a savings account in India. He has to mandatory convert his/her account into NRO/NRE or FCNR(B) Account.

Question: If a person leaves India for employment in Nepal or Bhutan, does he have to change the account to NRO Account?

Reply: No, a person resident in India leaving India for employment/business/vocation/any other purpose indicating his intention to stay for an uncertain period in Nepal or Bhutan has to continue with the resident account only.

Question: Can the sale proceeds of an immovable property credited to NRO account be repatriated back?

Reply: Yes, but repatriation from the NRO account is limited within an overall ceiling of $ 1 Million per financial year. In addition, RBI approval is required for a citizen of Pakistan, Bangladesh, Sri Lanka, China, Afghanistan, Iran, Hongkong, or Macau to repatriate this amount.

In case of any specific queries relating to the different Bank account options available or any issued of NRI relating to taxation, can contact at connect@osganconsultants.com